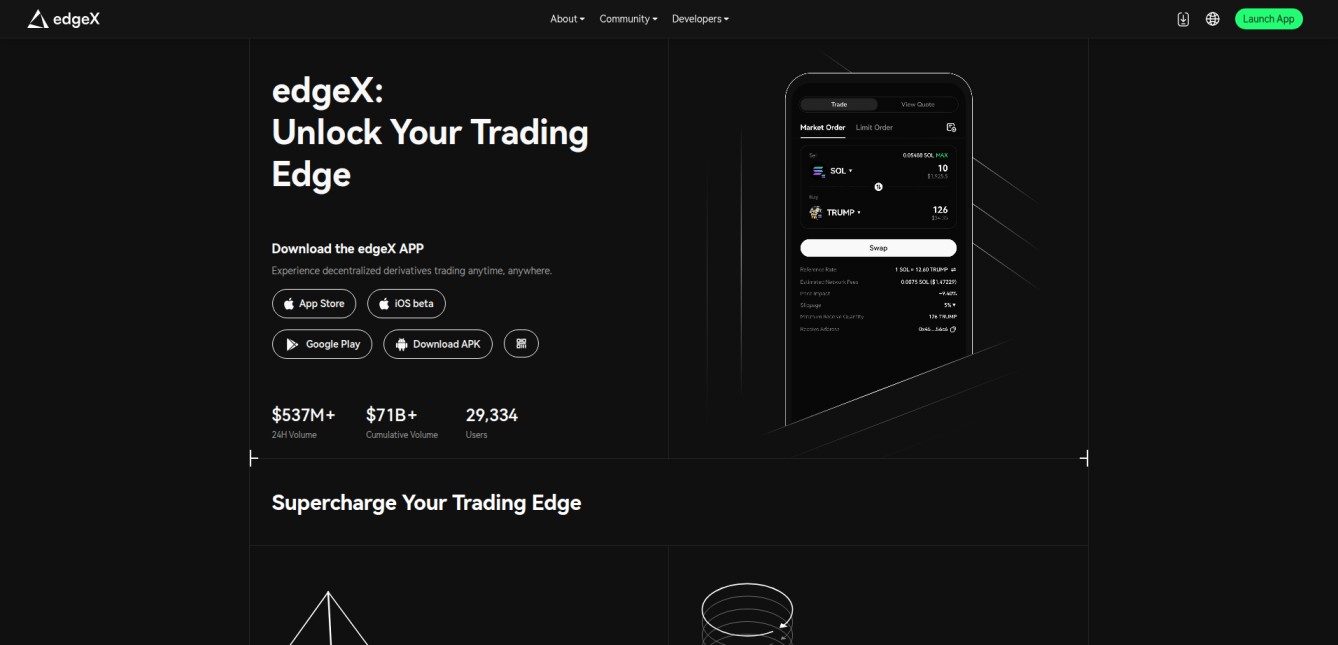

What is edgeX?

edgeX is a decentralized perpetuals exchange built on StarkEx, a ZK-rollup infrastructure developed by StarkWare. It enables 100x leverage trading with vault-based liquidity, zero slippage execution, and fully on-chain custody and settlement. Unlike hybrid DEXs, edgeX has no sequencer or off-chain matching engine – all logic runs through audited smart contracts.

The protocol is powered by isolated USDC vaults that supply liquidity for each trading market (e.g. BTC/USDC, ETH/USDC). Traders borrow from these vaults to open positions, while LPs earn yield from PnL and funding fees. Because vault liquidity is priced at the oracle mark price, trades execute without slippage or price impact, regardless of size.

edgeX introduces a unique block-by-block funding mechanism based on position skew, updating rates every block for fine-grained balance between longs and shorts. Margin, liquidation thresholds, and PnL are all managed per market, offering granular risk control. All margin is denominated in USDC, and the platform supports only isolated margin per position.

There is no native token yet, but a Points Program tracks both trading and LP activity in preparation for future rewards. edgeX’s architecture is fully composable, meaning external protocols can integrate directly with its vaults and execution layer.

By combining StarkEx scalability with DeFi-native design principles, edgeX delivers a no-compromise, on-chain leverage trading experience optimized for performance, capital efficiency, and trustlessness.