What is RabbitX?

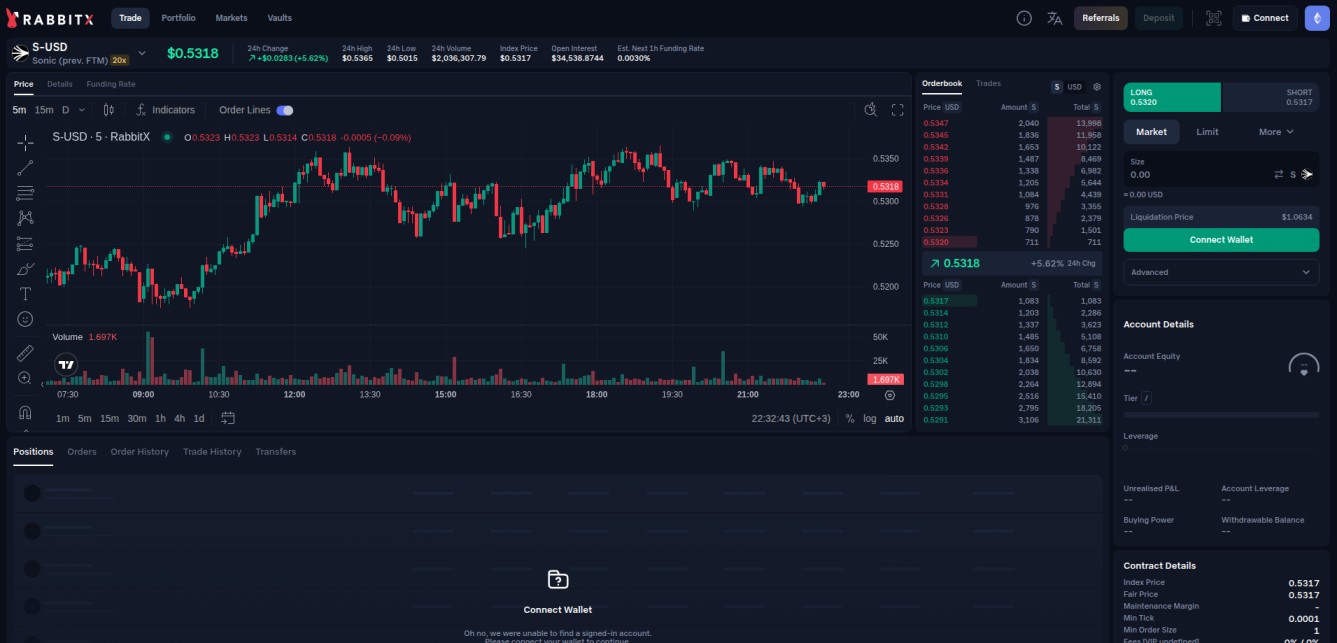

RabbitX is a decentralized perpetuals exchange built on Starknet, designed to bring high-speed, low-cost derivatives trading to Ethereum. It combines the performance of centralized platforms with the transparency and self-custody of DeFi, enabling traders to access over 100 markets with zero trading fees and up to 50x leverage.

At the core of RabbitX is a hybrid infrastructure that blends an off-chain order book for ultra-fast execution with on-chain settlement for full transparency and security. This architecture eliminates gas fees for deposits and withdrawals while ensuring that trades are finalized on-chain through Starknet’s zero-knowledge rollup technology.

RabbitX supports a wide range of synthetic markets—including BTC, ETH, gold (PAXG), and indices—making it a powerful venue for both crypto-native and traditional market traders. It also features advanced tools such as limit, stop, and market orders, as well as chart trading for technical analysis directly within the platform.

For liquidity providers, RabbitX offers an AMM vault system that allows users to earn passive yield on stablecoin deposits while backing the platform’s synthetic markets.

With an emphasis on speed, user experience, and product depth, RabbitX is positioning itself as the go-to decentralized alternative to CEXs for derivatives trading—powered by the scalability of Starknet and a frictionless UX.