What is Compound Finance?

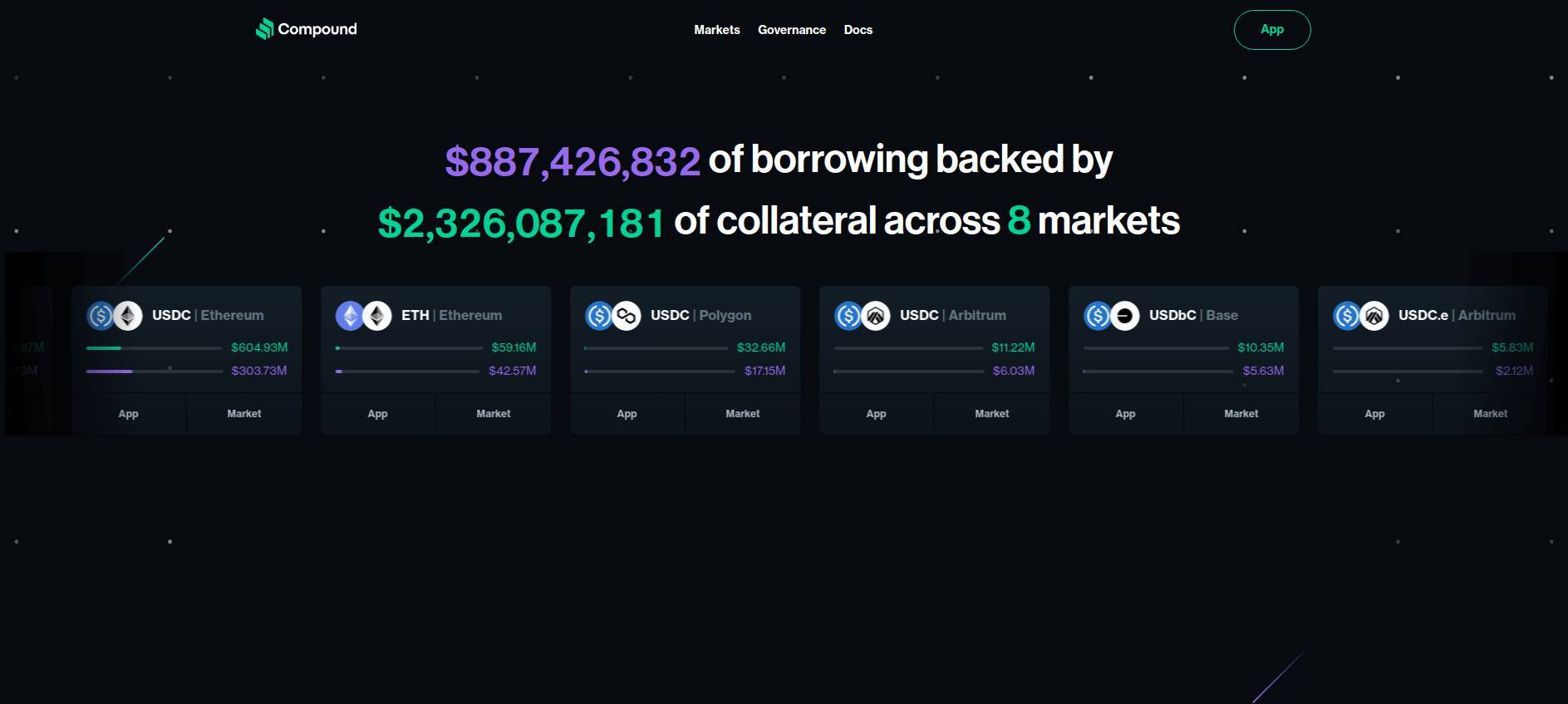

Compound Finance is a decentralized finance (DeFi) protocol that allows users to lend and borrow various cryptocurrencies in a decentralized and automated manner. Compound operates on the Ethereum blockchain and has expanded to support multiple Ethereum Virtual Machine (EVM) networks including Optimism, Base, and Arbitrum.

Compound functions as a money market, where users can supply assets to earn interest or borrow assets against collateral. When users deposit assets into Compound, they receive cTokens (such as cETH for Ether or cDAI for DAI) representing their deposits. These cTokens accrue interest and can be traded or used within other DeFi applications. The interest rates for lending and borrowing on Compound are algorithmically adjusted based on supply and demand dynamics.

The protocol supports a variety of cryptocurrencies including ETH, DAI, USDC, USDT, WBTC, and others. Users can interact with Compound through a Web3-enabled wallet like MetaMask. Borrowers must provide more collateral than the value of the loan to avoid liquidation, a process known as over-collateralization. If the value of the collateral falls too low, it may be liquidated to repay the loan.

Governance of the Compound protocol is decentralized and managed by holders of the COMP token. Introduced in 2020, COMP tokens enable users to propose and vote on changes to the protocol, including adjustments to interest rates, the addition of new assets, and other critical parameters. This governance model ensures that the protocol evolves in a way that reflects the interests of its community.