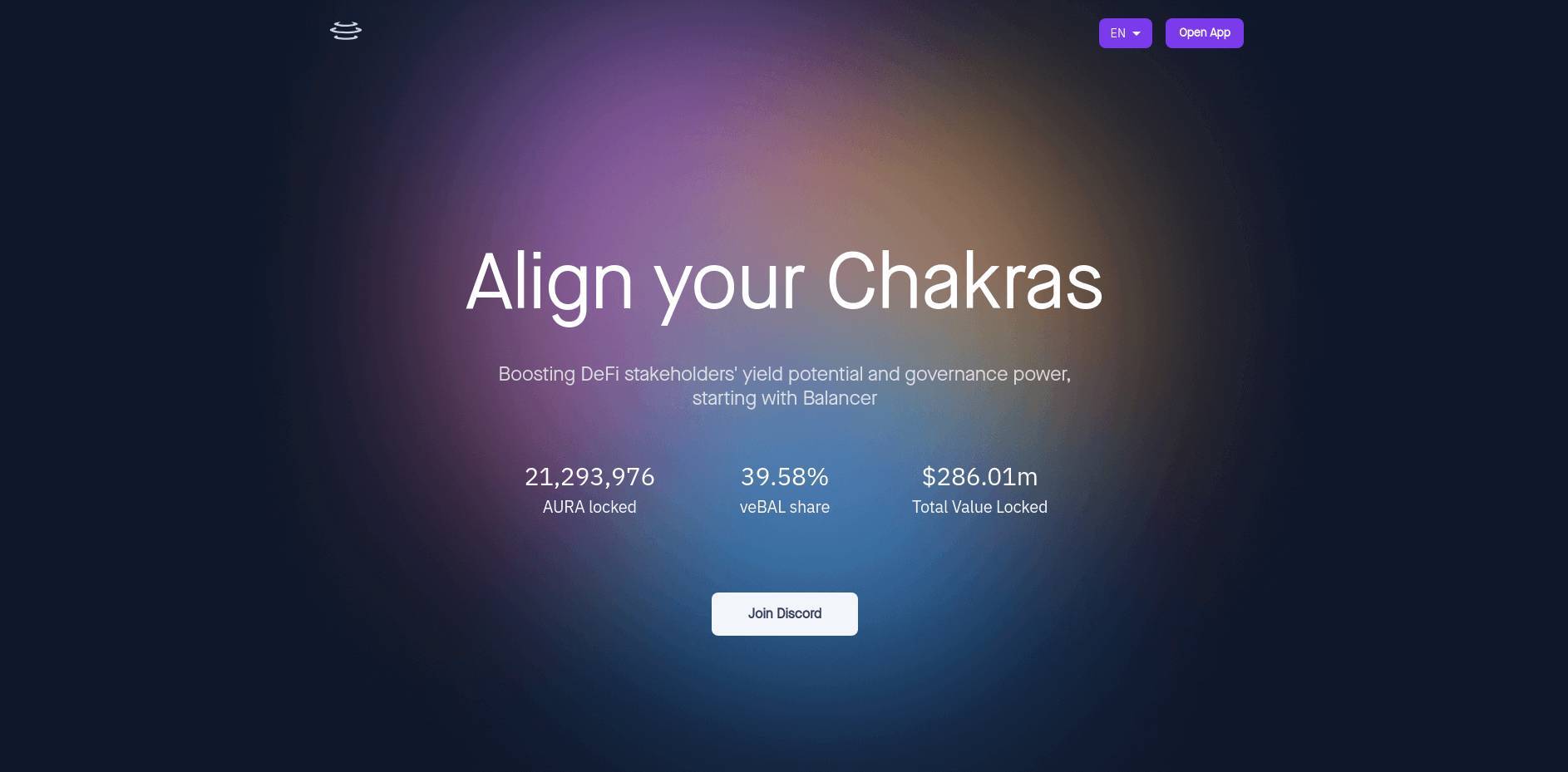

What is Aura Finance?

Aura Finance is a decentralized finance (DeFi) protocol built on top of Balancer, designed to enhance yield and governance power for users within the Balancer ecosystem. It simplifies and optimizes staking and liquidity provision processes, offering various features to maximize incentives for Balancer liquidity providers (LPs) and BAL stakers.

Aura Finance aggregates BAL deposits and uses its native token, AURA, to offer boosted rewards for LPs. By staking Balancer liquidity positions on Aura, users earn higher yields without needing to lock their BAL tokens themselves. The protocol controls a significant amount of veBAL (voting-escrowed BAL), which it leverages to provide these enhanced rewards. For BAL stakers, Aura provides a seamless onboarding process to veBAL through a tokenized wrapper known as auraBAL, which can be traded and staked to earn additional rewards, including BAL and AURA emissions.

Aura Finance operates with a decentralized governance model, allowing token holders to participate in governance decisions and vote on which Balancer pools receive BAL emissions. This system aligns the interests of the protocol's users and helps direct liquidity incentives effectively. The protocol has also expanded its operations to various Ethereum-compatible chains, such as Arbitrum, enabling users to benefit from lower gas costs while still participating in the protocol's incentive mechanisms.

Aura Finance aims to simplify the complexities of yield farming and governance on Balancer, providing a user-friendly interface and robust incentive structure to attract and retain liquidity.