What is MakerDAO?

MakerDAO is a decentralized finance (DeFi) platform built on Ethereum, facilitating the creation and management of the Dai stablecoin. Dai is a decentralized, collateral-backed stablecoin pegged to the US dollar, generated through collateralized debt positions (CDPs) within the Maker Protocol. Users lock various cryptocurrencies as collateral to mint Dai, ensuring stability and decentralization.

A notable feature of MakerDAO is its integration of real-world assets (RWA) into its collateral portfolio. This diversification strategy includes partnerships with entities like Galaxy Digital Trading Cayman LLC and other tokenized assets, contributing significantly to MakerDAO's revenue. Approximately 80% of the platform's fee revenue is derived from these RWAs, which enhance the stability and profitability of the protocol.

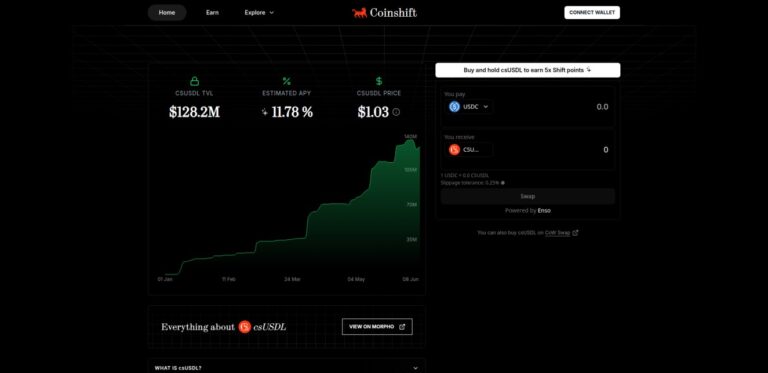

In 2023, MakerDAO launched the Spark Protocol, further enhancing its DeFi lending capabilities. Spark Protocol acts as a lending marketplace, offering supply and borrowing features for cryptocurrencies such as Ether (ETH), staked Ether (stETH), and Dai (DAI). This protocol is closely linked to Maker’s Direct Deposit Dai Module (D3M), allowing users to borrow Dai at competitive rates. Spark Protocol also includes SparkLend, a general-purpose borrowing and lending market, and the DAI Savings Rate (DSR) vault, which offers attractive yields for Dai holders.

The governance of MakerDAO is managed by MKR token holders who vote on protocol changes, ensuring that the system evolves to meet user needs while maintaining stability and security. The platform's focus on transparency, security, and community-driven governance makes it a significant player in the DeFi ecosystem.