What is Balancer?

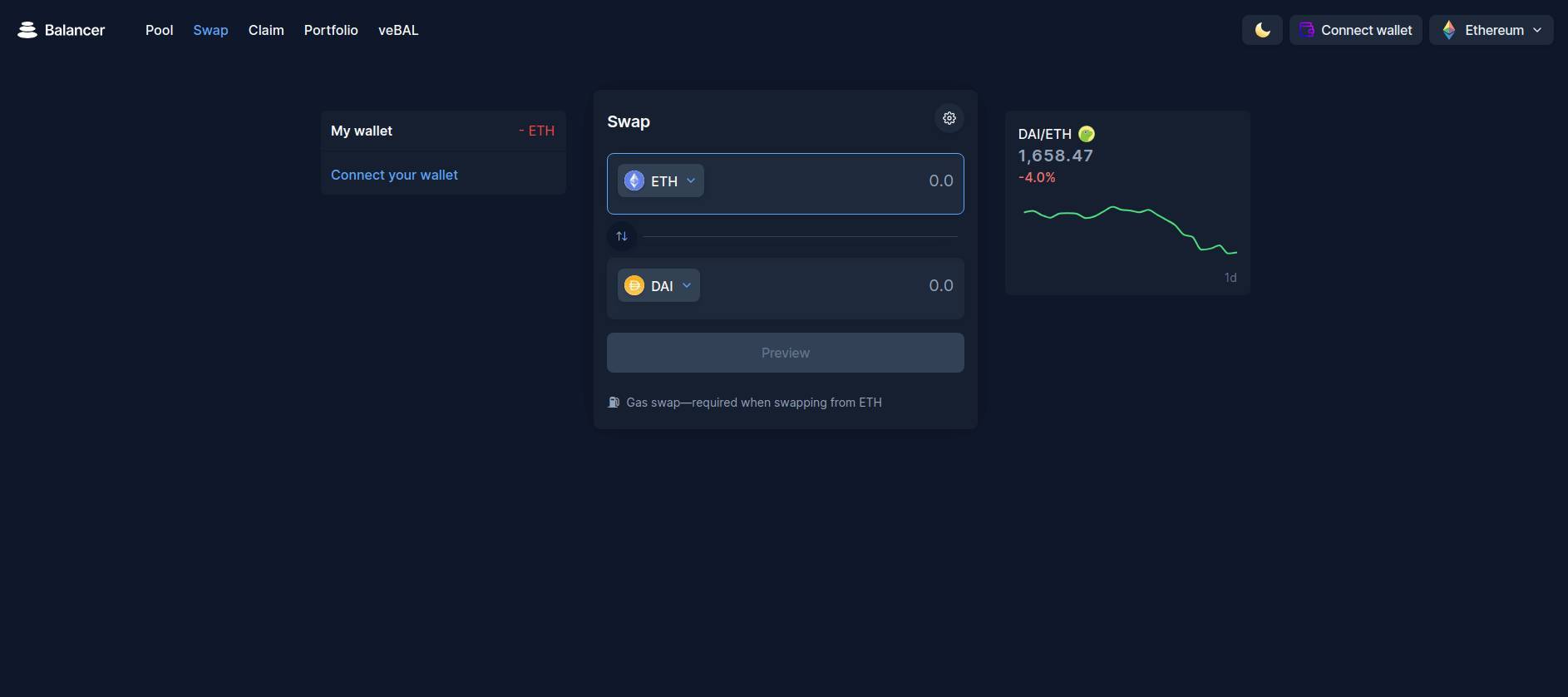

Balancer is a decentralized finance (DeFi) protocol designed as an automated market maker (AMM) and decentralized exchange (DEX). Unlike traditional exchanges that use order books, Balancer facilitates trades through user-created liquidity pools. These pools can contain up to eight different tokens, allowing for diverse and customizable liquidity options.

In a Balancer pool, liquidity providers deposit tokens in various proportions, creating a dynamic and flexible trading environment. For example, a pool might consist of 80% BAL and 20% ETH. If the value of ETH increases, the protocol automatically rebalances the pool to maintain the designated ratio, providing an efficient way to manage liquidity.

One of Balancer's unique features is its ability to serve as both a crypto trading platform and an automated asset management tool, similar to an index fund in traditional finance. This structure allows traders to exchange assets at optimal prices while liquidity providers earn a portion of trading fees and BAL tokens as rewards.

Governance of the Balancer protocol is driven by its native token, BAL, which allows holders to participate in decision-making processes, propose changes, and vote on various aspects of the platform.